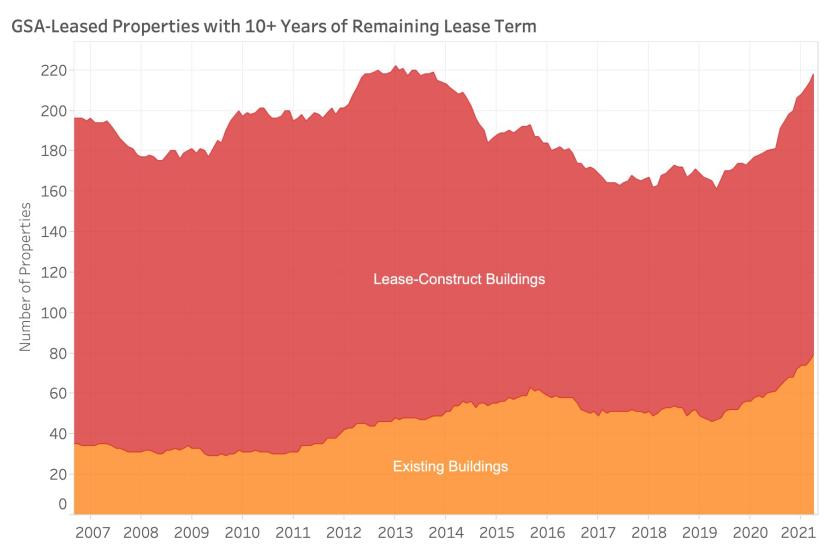

Despite a recent sharp decline in overall lease inventory, the number of long-term GSA-leased assets has come roaring back, nearly exceeding the peak of 222 achieved at the start of 2013. We examined the early stages of this recovery last September, and the number of long-term leased buildings has grown substantially since then. This reflects GSA’s official pivot five years ago with the publication of a revised “Lease Term Strategy” memorandum. The 2016 policy directed GSA real property officers to enter into longer leases whenever possible to achieve better rental rates and reduce the number of procurements GSA would face year over year. Now we are seeing those efforts reflected in the data as long-term leases are procured and commenced.

For investors concerned about the dwindling size of GSA’s leased inventory, it will be encouraging to see that there are increasing numbers of opportunities to fully harness federal government credit through long-term leased real property assets. If there is cause for concern, it’s that most of these new long-term leased buildings now feature second- or third-generation leases. GSA’s leased building inventory is greying, and even though long-term leased assets are more abundant, investors are finding far fewer opportunities to buy new buildings, especially build-to-suits.

From the inflection point in May 2019 to April 2021, 57 long-term leased buildings became available on a net basis (based on our study parameters of buildings ≥ 15,000 RSF and ≥ 85% GSA-leased). However, of those 57 new assets, only 13 were newly constructed or renovated buildings, 10 of which were lease-construct projects (i.e. build-to-suits).

Based upon the lease procurement trends we have seen over the last several years, we should expect additional long-term leased assets to come online as procurements are completed and new leases commence. Looking further forward, the COVID-19 pandemic may blunt the pace of long-term lease procurements, as some agencies are now electing to “kick the can” with short-term extensions while they determine their future workplace needs. GSA has acknowledged this uncertainty, issuing guidance that sanctions shorter 4-6 year lease terms. This tentative leasing approach may eventually manifest itself in the form of fewer long-term leased assets.